The banking, financial institutions, and fintech sectors encounter an escalating number of scams annually, broadly categorized into physical attacks, internal collusion, and digital fraud. In response, automation and machine learning have emerged as pivotal tools, enabling businesses to stay ahead of increasingly sophisticated fraud tactics in short they want to use AI in fraud detection. This article explores the adoption of AI techniques, such as machine learning, deep learning, natural language processing (NLP), neural networks, and decision trees, in the fight against fraud within the financial landscape.

The Landscape of Financial Fraud

Financial fraud takes various forms, from physical attacks and internal collusion to sophisticated digital scams. The evolving nature of these threats necessitates innovative approaches, and businesses are turning to AI techniques to bolster their fraud detection capabilities. This proactive stance allows companies to protect both their interests and those of their customers, ensuring financial losses are minimized in the realm of digital.

AI Techniques in Fraud Detection

Machine Learning Revolutionizing Fraud Detection Across Industries

Machine learning algorithms have evolved into indispensable tools, permeating diverse sectors such as fintech, investing, e-commerce, banking, healthcare, and online gaming. In this advanced landscape, these sophisticated algorithms stand as stalwart defenders against fraudulent activities. By adeptly processing colossal volumes of data, machine learning identifies intricate patterns, substantially contributing to the robustness of fraud detection mechanisms. The versatility of machine learning positions it as a powerful and adaptive tool, marking a paradigm shift in fortifying the resilience of businesses against emerging fraud threats. In essence, machine learning emerges as a cornerstone in the ever-evolving realm of AI in fraud detection.

Deep Learning’s Impact on Card-Related Fraud Prevention

The prowess of deep learning in fortifying financial security is exemplified by industry giant Mastercard. With an annual processing volume of 75 billion transactions spanning 45 million locations globally, the system harnesses the capabilities of self-teaching algorithms. This continuous learning approach significantly reduces fraudulent activities and false declines, underscoring the transformative impact of deep learning on card-related fraud prevention. As businesses navigate the dynamic landscape of AI in fraud detection, the integration of deep learning emerges as a strategic imperative for staying ahead of evolving threats.

Natural Language Processing (NLP): A Key Player in Anomaly Detection

Enterprises at the forefront of fraud detection, including American Express, Bank of New York Mellon, and PayPal, leverage Natural Language Processing (NLP) to enhance their capabilities. NLP extracts signals from diverse sources, including chat, voice, and IVR interactions, contributing to the effective identification and prevention of fraudulent activities over time. The evolving nature of NLP positions it as a key player in the ongoing battle against sophisticated fraud schemes, solidifying its significance in the expansive realm of AI in fraud detection.

Neural Networks: Mimicking Human Brain Structures for Enhanced Security

Emulating the intricate structure of the human brain, neural networks play a pivotal role in parsing historical transaction databases. These networks continually learn from past fraudulent transactions, progressively refining their accuracy over time. By effectively identifying patterns associated with habitual fraudsters, neural networks emerge as a cornerstone in the ongoing battle against the ever-evolving methodologies of fraud. As businesses embrace the potential of AI in fraud detection, neural networks stand out for their ability to enhance security through continuous learning.

Decision Trees: Crafting Comprehensive Frameworks for Fraud Detection

Within the dynamic landscape of fraud detection, decision trees serve as visual representations of decision-making processes. These trees identify critical variables contributing to fraud, creating comprehensive frameworks for identifying and addressing fraudulent transactions. As businesses navigate the intricate realm of AI in fraud detection, the application of decision trees emerges as a strategic element, strengthening the analytical foundation and enhancing overall efficiency in combating fraud.

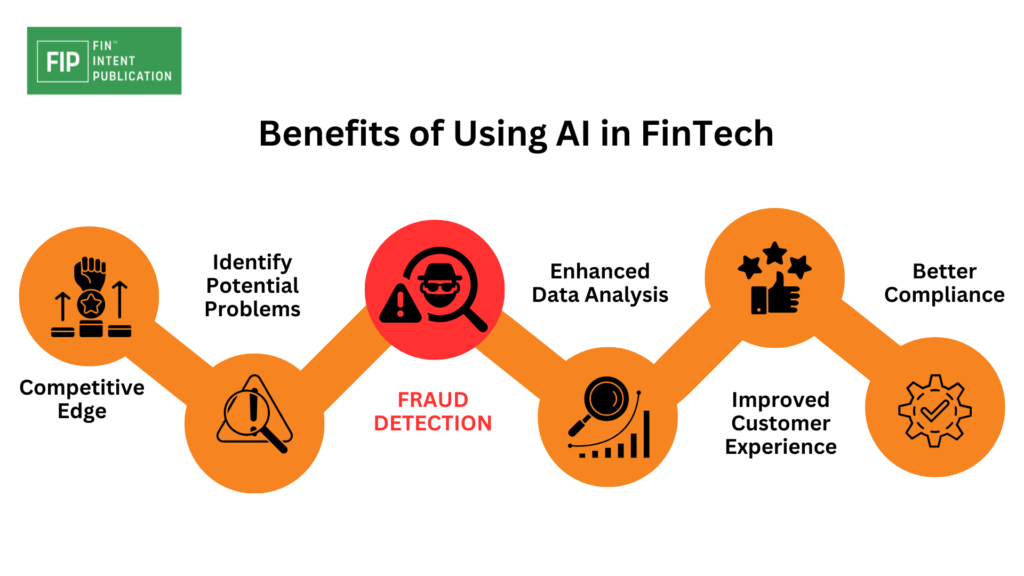

Advantages of AI-Based Fraud Detection Systems

AI-based fraud detection systems offer a superior approach to traditional methods, providing real-time data analysis, intricate fraud pattern detection, and adaptability to emerging fraud schemes. By reducing false positives and streamlining manual reviews, these systems increase accuracy and efficiency in fraud detection, resulting in fewer financial losses. From a customer experience standpoint, quick and accurate fraud detection prevents customers from falling victim to financial fraud, enhancing loyalty and retention.

Conclusion

The potential of AI in fraud detection is immense, revolutionizing how the banking, financial, and fintech industries combat evolving threats. While AI-based systems offer enhanced security, reduced financial losses, and improved operational efficiency, considerations such as data quality, ethical implications, and regulatory compliance must be addressed. The continuous investment in and collaborative development of AI-based systems will further refine their effectiveness in fraud prevention. Financial institutions should remain at the forefront of these advancements to ensure a secure and resilient future in the face of evolving fraud landscapes.