The world of finance is undergoing a digital revolution, with robo-advisors emerging as a powerful force. These automated investment platforms are shaking up the traditional financial landscape by offering a convenient, affordable, and data-driven approach to investing.

What are Robo-Advisors?

Imagine having a financial advisor available 24/7, who tailors investment strategies based on your unique goals and risk tolerance, all for a fraction of the cost. That’s the essence of a robo-advisor. These AI-powered platforms utilize sophisticated algorithms to build personalized investment portfolios, automatically rebalance them and offer ongoing investment management – all without the need for a human advisor.

Accessibility for All

Traditionally, investing felt like an exclusive club with a hefty membership fee. High minimum investment amounts and advisor fees often priced out those just starting their financial journey. Robo-advisors are changing that.

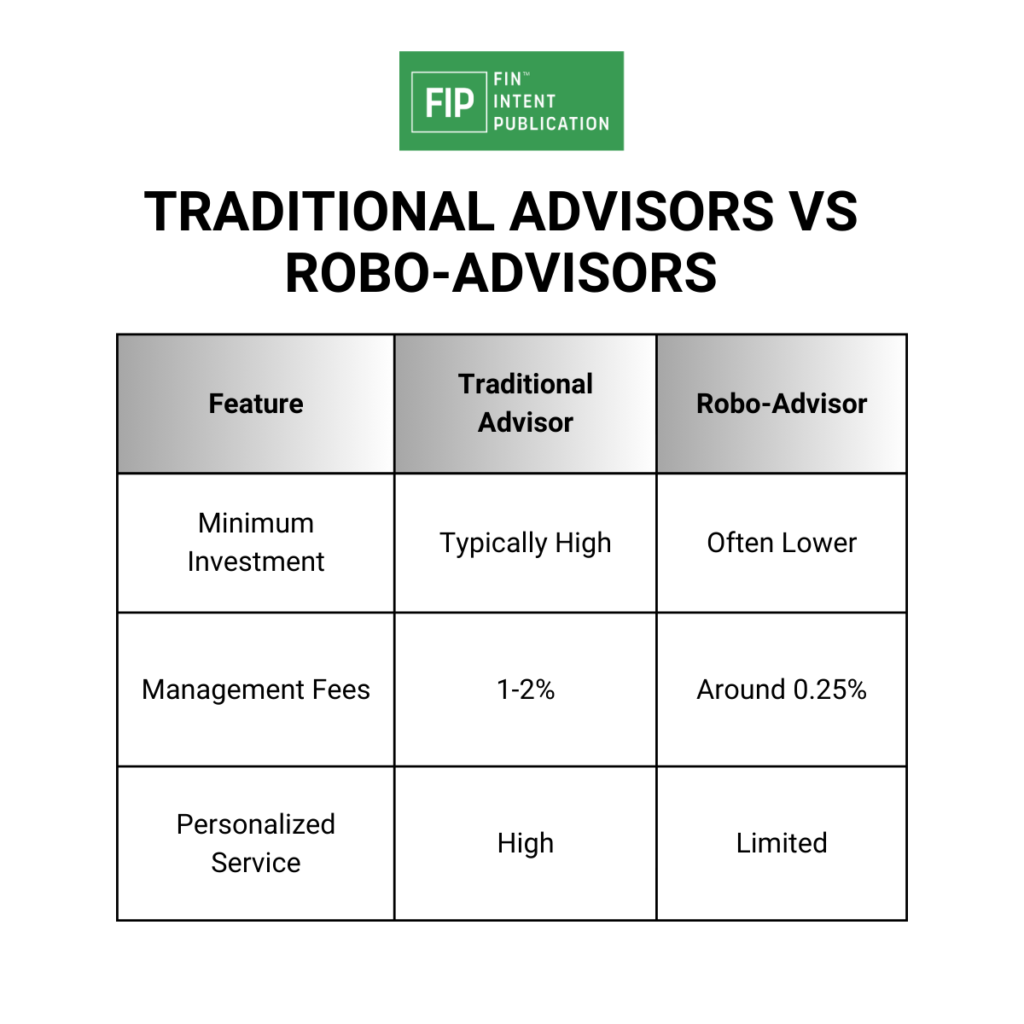

- Lower Costs: Unlike traditional advisors who typically charge 1-2% in management fees (according to a Backend Benchmarking study), robo-advisors average around 0.25%. This significant reduction opens the door for a wider range of investors, especially millennials and Gen Z entering the market with smaller initial balances.

- Millennial Momentum: A 2023 Charles Schwab survey highlights this trend, with 23% of millennials reporting using a robo-advisor.

Here’s a table comparing traditional advisors and robo-advisors:

Making Investing Accessible

Robo-advisors remove the financial barrier to entry by offering:

- Lower Minimums: Many robo-advisors have lower minimum investment requirements compared to traditional advisors. This allows individuals to start investing with smaller sums and gradually build their wealth over time.

- Affordability: The significantly lower fees associated with robo-advisors make investing a more realistic option for a broader audience.

Investing Made Simple:

Robo-advisors not only make investing accessible but also simplify the process. Here’s how:

- User-Friendly Platforms: Through online interfaces, robo-advisors ask you a series of questions about your goals, risk tolerance, and investment timeframe.

- Automated Portfolios: Based on your answers, the platform builds a diversified portfolio of low-cost ETFs (Exchange-Traded Funds) that align with your risk profile.

- Automatic Rebalancing: Robo-advisors automatically rebalance your portfolio periodically, ensuring it stays on track with your goals.

Robo-advisors: Are They Right for You?

While offering numerous advantages, robo-advisors may not be a perfect fit for everyone. Consider these factors:

- Complexity: If your financial situation is complex or requires specialized investment strategies, a human advisor might be a better choice.

- Investment Options: Robo-advisors typically offer a limited range of investment options compared to traditional advisors.

The Future of Investing

The robo-advisor industry is young but rapidly growing. A Grand View Research report predicts the global robo-advisor market to reach USD 48.8 billion by 2028. As AI and machine learning evolve, we can expect even more sophisticated robo-advisors offering:

- More Complex Strategies: Catering to a wider range of investor needs.

- Personalized Financial Advice: Going beyond just investing.

Democratizing Investment Strategies

Robo-advisors take the complexity out of investing. Through a user-friendly online interface, they ask you a series of questions about your financial goals, risk tolerance, and investment timeframe. Based on your answers, the platform builds a diversified portfolio of low-cost exchange-traded funds (ETFs) that align with your risk profile.

ETFs offer a basket of underlying securities, such as stocks or bonds, providing instant diversification and reducing overall risk. Robo-advisors automatically rebalance your portfolio periodically, ensuring it stays aligned with your risk tolerance and investment goals. This “set it and forget it” approach is ideal for busy individuals who don’t have the time or expertise to actively manage their investments.

The Power of Automation

The algorithms powering robo-advisors are constantly analyzing market data and trends. This allows them to make data-driven investment decisions and react to market fluctuations quicker than human advisors. Additionally, they remove the emotional element from investing, which can often lead to poor decision-making during market downturns.

Are Robo-Advisors Right for Everyone?

While robo-advisors offer numerous advantages, it’s important to understand their limitations. They may not be suitable for investors with complex financial situations or those seeking more personalized guidance. Additionally, robo-advisors typically offer a limited range of investment options compared to traditional advisors.

For individuals with a high net worth or those requiring specialized investment strategies, a human advisor can provide a more tailored approach. However, for the growing number of individuals seeking a convenient and affordable way to invest, robo-advisors offer a compelling alternative.

The Future of Robo-Advisors

The robo-advisor industry is still in its early stages, but its growth trajectory is undeniable. A report by Grand View Research predicts that the global robo-advisor market size will reach USD 48.8 billion by 2028, indicating the increasing acceptance of this technology.

As artificial intelligence and machine learning continue to evolve, we can expect robo-advisors to become even more sophisticated. They may incorporate more complex investment strategies, offer personalized financial advice beyond just investing, and cater to a wider range of investor needs.

Conclusion

The rise of robo-advisors is democratizing investing, making it accessible and affordable for a broader audience. By leveraging technology and automation, these platforms offer a convenient and data-driven approach to wealth management. While they may not replace traditional advisors entirely, robo-advisors are undoubtedly reshaping the financial landscape, making investing a more inclusive and accessible experience for everyone.