The last decade has seen around 400 launches of licensed neobanks. The global neobank market was worth USD 18.6 billion in 2018 and is expected to accelerate at a compounded annual growth rate (CAGR) of around 46.5% between 2019 and 2026, generating around USD 394.6 billion by 2026.

The financial services landscape is undergoing a tectonic shift. Neobanks, or challenger banks, are rapidly disrupting the traditional, brick-and-mortar model with entirely digital solutions. This article delves into the essence of neobanking, exploring its core tenets, value proposition, and the transformative impact it’s having on the financial ecosystem.

Definition: Neobanking

Neobanks are online-only financial institutions that provide traditional banking products and services (such as checking accounts and debit cards) through their website rather than a brick-and-mortar branch. Neobank, fintech bank, challenger bank, and digital bank are various terms that describe the same type of financial institution. By providing banking services solely through digital channels, neobanks hope to simplify the banking process for their customers. NuBank is the largest Neobank globally.

The image below has been taken from PWC.

Neobanking: Top News of 2024

- Brazilian neobank Nubank has hit 100m customers.

- Neobank Jupiter’s NBFC business raises Rs 20 crore from Peak XV, Matrix in June 2024.

- London-based Fintech Farm, a startup that sells technology to medium-sized banks in emerging markets to build digital tools, has raised $32m in funding.

- Neobanking startup Fi, backed by investors such as Peak XV and Temasek, has secured a non-banking finance company (NBFC) licence from the Reserve Bank of India, enabling it to provide loans from its own books.

- Tiger Global and Peak XV Partners-backed neobanking startup Jupiter has secured a prepaid payments instrument licence from the Reserve Bank of India.

- Youth-focused neobanking startup Muvin has shut down its operations, according to sources aware of the development and the company’s communication with its users.

- 47 Neobank startups like Finex, Numo, Coba etc. have been funded by Y Combinator

Neobanking: Top Trends 2024

- Integrating AI: AI and automation are enabling personalized and intelligent financial services. AI-powered chatbots and virtual assistants are the main tools neobanks use to improve customer interactions and resolve issues.

- Offering highly customized experiences: Personalized experiences powered by machine learning are already standard practice for neobanks across all consumer touchpoints. The most effective ones also tailor user experiences to each individual’s goals, current situation, and past actions, as well as their trajectory (by, for instance, anticipating their level of happiness and the best course of action to take next), and past experiences.

- Chatbots: This allows them to use natural-language processing tools to combine the customer’s context and intent, resulting in superior engagement. WeBank, a Chinese financial institution, asserts that its AI chatbots handle nearly 98% of consumer inquiries.

- Global expansion: Neobanks started in the U.S. and Europe but have now expanded to all parts of the world. The demand for innovation in financial services, as well as better internet and smartphone penetration, allowed this global adoption.

- Regulatory evolution:: As neobanks continue to disrupt the banking landscape, regulatory authorities are trying to adapt existing frameworks to accommodate these innovative fintech firms.To tackle this, neobanks often partner with licensed banks. This is how they manage to provide insured deposit accounts while complying with regulatory requirements.

- Expansion into niche markets and verticals: Neobanks are increasingly targeting niche markets and specific customer segments to set themselves apart and offer tailored financial solutions. Neobanks specialize in identifying and serving the needs of markets that are of no particular interest to incumbents.

- Collaboration with traditional banks: This is to leverage each other’s strengths and deliver hybrid banking experiences. Neobanks offer a variety of digital capabilities and their agility can greatly benefit traditional banks..

Neobanking: How Do They Work?

- Since all banking operations are conducted online, these institutions do not require any kind of physical facility or staff to operate. Still, accepting deposits and extending credit is their bread and butter, just like any other conventional bank.

- It offers cutting-edge banking services through simple, straightforward mobile apps in collaboration with well-established financial institutions.

- Providing immediate digital customer service to address difficulties as soon as they arise, these banks handle customer acquisition from beginning to finish.

- The money their clients deposit with them is typically held by their banking partners, who also provide them access to that money for loans.

Redefining Banking: The Neobanking Core

Transaction value in the Neobanking market is projected to reach US$6.37tn in 2024 – Statista Report

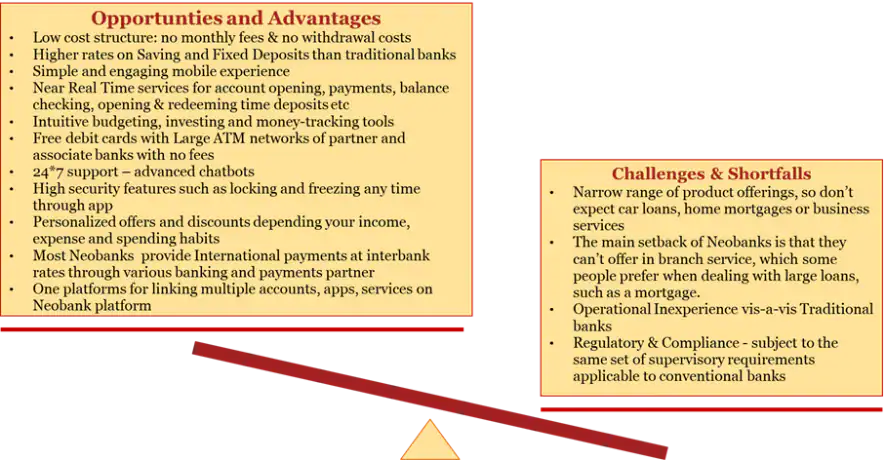

Unlike traditional banks burdened by legacy infrastructure, neobanks are built from the ground up on a digital foundation. They operate entirely online, leveraging cloud-based platforms and APIs to provide a seamless, mobile-first user experience. This translates to:

- Frictionless Account Opening: Gone are the days of lengthy in-person applications. Neobanks offers swift account creation processes, often completed within minutes through intuitive mobile apps.

- Streamlined Account Management: Forget paper statements and limited banking hours. Neobanks provide real-time account visibility, integrated budgeting tools, and 24/7 customer support – all accessible through a user-friendly interface.

- Innovative Financial Products: Neobanks aren’t confined by traditional product silos. They offer a plethora of innovative features, including fee-free international transactions, real-time expense categorization, and embedded micro-investment options directly within the banking app.

Beyond Convenience: The Value Proposition of Neobanking

Neobanks offer more than just digital convenience. They cater to a tech-savvy generation that demands a personalized and transparent banking experience. Here’s how neo banks are redefining value for customers:

- Focus on Financial Wellness: Neobanks go beyond basic transactions, offering budgeting tools, gamified financial goals, and spending insights to empower users to make informed financial decisions.

- Enhanced Security: Cloud-native architecture allows neobanks to leverage cutting-edge security protocols, including biometrics and real-time fraud detection.

- Open Banking Integration: Neobanks embrace Open Banking APIs, fostering a more connected financial ecosystem. This allows users to seamlessly integrate third-party financial products and services within their neobank platform.

The Disruption Engine: Why Neobanks Matter

The rise of neobanks is not merely a fad; it’s a catalyst for change. Here’s how neobanks are impacting the financial landscape:

- Increased Competition: Neobanks are forcing traditional banks to innovate and improve their digital offerings to retain customers. This fosters a more competitive environment, ultimately benefiting consumers.

- Financial Inclusion: Neobanks, with their lower operating costs and focus on digital accessibility, can reach underserved communities that traditional banks often neglect.

- Data-Driven Innovation: Neobanks leverage user data (with consent) to personalize financial products and services, paving the way for a new era of data-driven financial decision-making.

Which Countries Exhibit the Greatest Neobank Adoption per Capita?

As of Q3, 2023, the following information provides country-specific data on the number of individuals with a neobank account (sourced from Finder). This has also been expressed as a percentage of each country’s population (based on the statistics of Our World in Data via Visual Capitalist).

Popular Neobanks in US

Based on a combination of factors including customer reviews, features offered, and overall value, here are the top neobanks in the US:

- Chime: Known for its fee-friendly approach, Chime Financial offers a mobile-first checking account with free ATM withdrawals within its network, early access to direct deposits, and a security-first mentality. The fintech company was recently in the news for offering consumers with advanced withdrawal services of up to $500 from their paycheck accounts. The neobanking service provider is monetizing its fee-free cards with exceptional customer service for “manage money”.

- SoFi: SoFi goes beyond traditional banking, offering checking and savings accounts, debit cards, loan options, and even the ability to invest all through their user-friendly app.

- Current: Current focuses on building financial wellness for families. They offer fee-free banking with parental controls, educational tools, and a rewards program.

- Wise (formerly TransferWise): Wise is a global leader in money transfers, offering competitive exchange rates and low fees. They also provide a debit card and a US bank account for international customers.

- Varo Bank: Varo offers a mobile-first checking account with interest-bearing balances, early access to direct deposit, and tools to help you build your credit score.

- MoneyLion: MoneyLion is a financial platform that offers a checking account, credit-building tools, and access to investment opportunities. They also have a rewards program that allows you to earn cash back on debit card purchases.

- Upgrade: Upgrade offers a variety of financial products, including a mobile-first checking account, credit cards, and personal loans. They are known for their focus on helping customers improve their credit scores.

These are just a few of the many neobanks available in the US. The best neobank for you will depend on your individual needs and priorities. Consider what features are most important to you, such as fees, interest rates, and mobile app functionality, before decision-making.

The Future of Finance: A Collaborative Landscape

While neobanks are challenging the status quo, collaboration with established financial institutions is likely. We may see:

- Partnerships: Traditional banks partnering with neobanks to leverage their innovative technology and customer base.

- Acquisitions: Acquisitions by traditional banks to bolster their digital offerings and compete more effectively.

- Hybrid Models: The emergence of hybrid models offering the best of both worlds: traditional bank stability with neobank innovation.

Neobanks are not simply digital upstarts; they are the harbingers of a new financial era. Their focus on user experience, innovative features, and financial wellness is prompting a paradigm shift in the way we bank. As neobanks continue to evolve and collaborate with traditional institutions, the future of finance promises to be more inclusive, data-driven, and ultimately, more empowering for the customer.

Neobanking: FAQ’s

1. How is a neobank different from a traditional bank?

Answer: Neobanks operate exclusively online, which allows them to reduce overhead costs and offer more competitive rates and fees. Traditional banks have physical branches and offer a wider range of services, including in-person banking.

2. Are neobanks safe to use?

Answer: Yes, most neobanks use advanced security measures such as encryption, two-factor authentication, and biometric verification to protect users’ data. Many neobanks are also regulated by financial authorities in their respective countries.

3. How do neobanks make money?

Answer: Neobanks generate revenue through various means, including interchange fees from card transactions, interest on loans, premium account features, and partnerships with other financial service providers.

4. What services do neobanks offer?

Answer: Neobanks typically offer services such as savings accounts, checking accounts, money transfers, budgeting tools, and sometimes lending and investment products.

5. Can I get a loan from a neobank?

Answer: Some neobanks do offer personal loans and credit products. However, availability varies by neobank, and not all neobanks provide lending services.